HOW TO TRADE PRE-IPO COMPANIES

Chad Gracia works as a broker of private secondary companies, introducing buyers and sellers directly so they can complete transactions.

If you are an accredited investor and want to buy or sell private companies (we’ve traded hundreds of unicorns from Anthropic to SpaceX), I can help. The process is open to US and international investors, but we follow all relevant SEC, FINRA, and Patriot Act requirements. You should consult your financial advisor and read the disclaimer below as a first step. Here is an overview of the process.

Step 1: Ensure You Are an Accredited Investor via our “Client Engagement Form”

We generally work with institutions (family offices, banks, sovereign wealth funds, venture capital funds, pension funds, and more). If you are an individual (retail investor) we may be able to work with you if you meet these requirements. To find out, please submit one of these forms (be sure to list “Chad Gracia” and “cgracia@rainmakersecurities.com) on the first page where it asks “Referring Agent”:

A. Individual / Retail (Natural Entity): https://www.rainmakersecurities.com/client-engagement-form-for-natural-persons

B: If Entity (Institution), use this form: https://www.rainmakersecurities.com/client-engagement-form-for-entity-persons

Step 2: Educate Yourself about the Pre-IPO Market

The secondary market is a financial market in which existing stocks, options, and other financial instruments are purchased from or sold to other investors.

1. Understand Common Acronyms:

LR: Last Round, the price at which the company last conducted a direct primary raise.

Direct Transfer: A direct transfer of ownership of shares whereby the share certificate changes hands and the new owner becomes a legal owner in the company, bound by the bylaws associated with those shares. Also known as “being on the cap table.” Drawbacks include having to wait for a 30 day ROFR period. Many companies (SpaceX, Anthropic, Open AI, etc.) forbid direct transfers.

SPV: Special Purpose vehicle, or “Fund” — used to hold securities, and which provides investors a way to own a company that blocks direct transfers. They often come with fees, an annual “management fee” and a “carry” (written 1/10 or 2/20, for instance). A “clean” fund has no fees, or 0/0. Some SPVs directly own shares (single layer), while others own shares in another SPV (double-layer).

Forward: A contract that allows a seller to receive payment now with delivery when shares are transferable (used when company’s block direct transfers). This is generally forbidden by the SEC without a company waiver, unless both buyer and seller meet these strict requirements.

STN (Share Transfer Notice: An unofficial notice to the company that an individual intends to sell their shares. It serves to start the (general) 30-day ROFR clock as well as to give the company an opportunity to block the transfer, if that is allowed by their bylaws.

SPA (Share Purchase Agreement, aka STA): This is the formal contract that the buyer and seller sign to effect the transfer of sale. Once signed, the buyer generally wires cash to the account of the seller, the company is notified, and the company countersigns and the ledger is updated with the new buyer (usually Carta).

ROFR: Right of First Refusal. Generally a company, or other early investor, has the right to buy shares from a seller at the price agreed upon between seller and buyer. Therefore, you may not end up receiving shares you bid for if the price is too low, even if a seller agrees. See below.

Lock-up: Most, but not all, private shares have a lock up period (30-90 days) after IPO before they can be traded on the open market.

2. Why are common shares worth less than preferred shares?

The two types of equity in a company are preferred shares and common shares. The price for preferred shares is the price per share paid by investors in a Series funding round. Due to their low exercise price once converted from options, especially when issued early on, common shares often have a very low cost basis. In contrast, the cost basis of preferred shares is usually higher, as it is determined by the price per share in the latest funding round.

In comparison to common shares, preferred shares have additional economic advantages such as a “liquidation preference,” meaning that should a company’s assets be liquidated, shareholders of preferred stock are able to redeem their shares first. Furthermore, in non-participating dividend rights, the investor has the choice of either exercising liquidity or converting preferred shares into common shares. The lower risk investors take on with preferred stock is reflected in its higher price.

3. What are some obstacles that can present themselves in a secondary transaction?

A private later stage company has the option of restricting secondary transactions. Companies may block secondary transactions especially when nearing an IPO or round of funding. In the scenario of an IPO, the additional changing share ownership complicates the process. In both IPO’s and series funding, obstacles arise from the market uncertainty, delaying the secondary process as sellers may wait for price appreciation and buyers may desire greater market transparency.

Private firms desire a trustworthy and limited number of investors to ensure the alignment of company interests and prevent frequent short-term trading of shares. Additionally, firms use the ownership of shares both as compensation for employees and as a method of increasing employee retention. Thus, firms often require board approval when processing secondary transactions and only allow sponsored secondary tenders as means of liquidity. Sponsored secondary transactions consist of startup employees selling shares to venture capital firms.

Furthermore, there may be additional costs where some firms will require legal opinion to ensure the transferal of stock rights from seller to buyer; the price of this process typically ranges between $5K - $7K. For this reason, minimum transaction sizes are generally $250,000.

4. What is ROFR?

ROFR, otherwise known as the Right of First Refusal, is the company’s option to decline a buyer from purchasing shares in a company. In presenting the company with an STA, a binding document stating the buyer’s desired number of shares and price per share (or a Transfer Notice), under the ROFR, the company typically has 30 days in deciding to refuse the transaction. However, in some cases, the company’s bylaws may state the ROFR only last a few weeks or may take several months.

Should the company exercise their ROFR, the seller would still be compensated for the sale of their shares, although the company itself or an early shareholder would be the buyer. Even if the ROFR process were triggered, the seller would still receive funds instead of the initial buyer.

If ROFR doesn’t occur, the initial buyer would successfully obtain the shares and transfer the seller the agreed upon funds.

5. How long does a secondary transaction take?

Once the buyer and the seller have signed the STA, the transaction will then proceed to the ROFR stage. Furthermore, a few weeks are required to officially close the transaction in which the buyer wires the seller funds and the company transfers official ownership of shares to the buyer (a conservative estimate is 50 days). In some cases, preferred stock transactions are exempt from the ROFR period and only require a few weeks closing. SPV or Fund transactions can be completed within a week.

6. Why might a seller want liquidity?

Through the sale of their shares, the seller is compensated with liquidity that can finance personal needs such as starting a business, buying a new house, or paying for college expenses of their children. Institutional investors such as VC funds often sell shares in order to rebalance their portfolios.

7. Can I sell my shares with those of colleagues to form a larger transaction size?

While some buyers will agree to work on a “bundled trade,” for confidentiality and compliance reasons, every owner’s trade is siloed and has a separate trade roadmap (both in the eyes of the company and the buyer). So, for instance, the company could block or ROFR one transfer and not another, any transfer fees are paid on each separate transaction and of course each SPA, payment, Carta entry, etc. is unrelated to the others. Of course, some buyers are willing (or even required by size limitations) to conduct multiple transactions in parallel, and I have facilitated many of these.

8. What happens when a company achieves an exit?

There are two ways in which a company achieves an exit: an IPO and an M&A.

In the case of an IPO, the value of the common shares and preferred shares converge in either a stock split or reverse stock split. However, most common shares have a 6-month lock up period in which insiders who held shares before the company went public can’t sell for a specified period of time.

The second case is an M&A exit, in which the private firm undergoes “the waterfall phenomenon.” Following the sequential waterfall of investment (ex. Series E, Series D, . . . Series A), the most recent preferred shareholders can withdraw their initial equity or receive upside on their investment. In the case of Pari Passu liquidation, preferred shareholders regardless of funding round have the same seniority status which means that every investor will receive a portion of the proceeds. After the preferred shareholders obtain liquidity, common shareholders have access to the remaining capital.

9. Does RainMaker have exclusivity in marketing seller’s shares?

No, Rainmaker doesn’t have exclusivity and is in competition with other firms focused on secondary market transactions.

10. Where does RainMaker get historical pricing?

RainMaker obtains pricing data such a “Last Round,” valuation, etc. from Pitchbook. If there is a stock split or reverse stock split, Rainmaker representatives utilize alternative databases for pricing information, as well. For indicative pricing, we use third party bid/ask aggregators, our experience with recent transactions, and our order books, which contain hundreds of datapoints.

11. Where can I get research on companies Rainmaker covers?

Research reports are available for accredited investors here.

12. What opportunities are available?

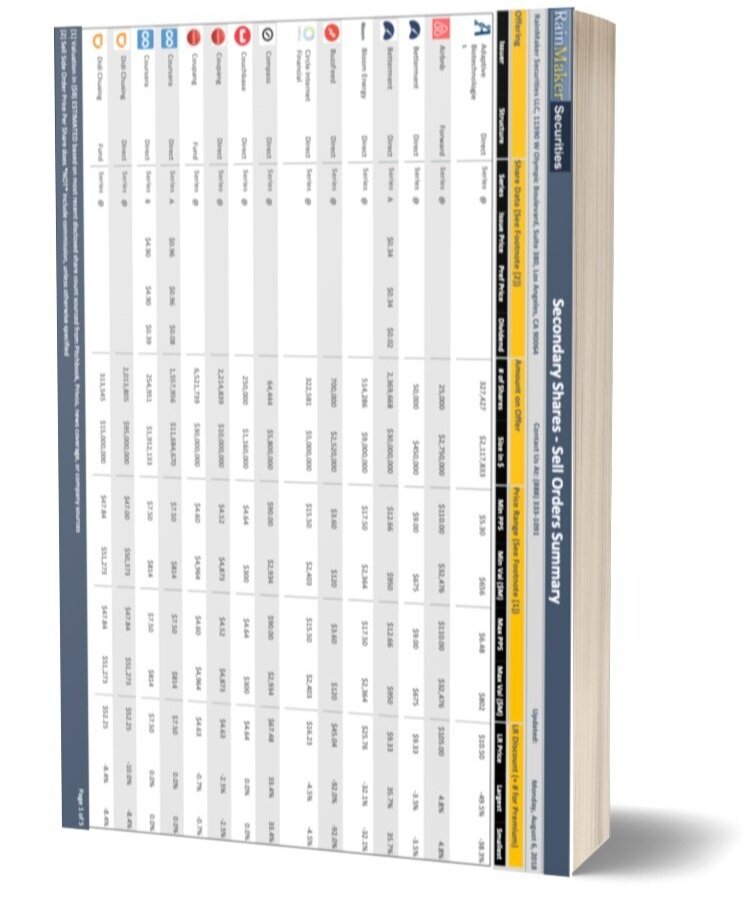

Our book is here.

Step 3: More Reading: Top Ten Mistakes IPO Investors make here.

Bonus: Hundreds of Pre-IPO News Articles Here.

Step 5: Review our Highlighted Trades here and Request Access to our Full Book by emailing cgracia@rainmakersecurities.com.

Chad Gracia focuses on helping U.S. and international private equity, venture capital and real estate fund managers to build strong LP relationships in the Middle East, where he has raised more than $1 billion for his clients. For more than twenty years, he has worked with high net worth individuals in the region, as well as advised Saudi ambassadors, the Saudi Royal Court, the Bahrain Royal Court, various regional institutions, the Emerging Markets Private Equity Association (EMPEA) as well as the U.S. government. As a placement agent, The Gracia Group has represented some of the largest hedge fund and private equity funds in the world; in real estate, we were chosen by Gary Barnett of Extell Development to lead their Middle East relationship-building efforts.

From 2013-2019, the Gracia Group was been the private sector mission leader for U.S. Commerce Department Certified Private Equity and Real Estate trade missions to Saudi Arabia, Kuwait, the UAE and Oman, where he has introduced fund managers to more than 100 active LP allocators, including dozens of local family offices and all of the regional sovereign wealth funds. His delegations were hosted at the homes of US ambassadors in Saudi Arabia, Oman and throughout the region. He has worked closely with U.S. embassies and ambassadors to introduce these delegations to local LPs.

Mr. Gracia is also a registered securities broker who trades pre-IPO tech unicorns via the broker-dealer, Rainmaker Securities. He is Series 7, 63 registered with FINRA.